deferred sales trust cons

Are you interested in becoming a deferred sales trust expert. Taxpayers using the Deferred Sales Trust.

Deferred Sales Trust The 1031 Exchange Alternative Debt Free Dr Dentaltown

A Deferred Sales Trust is a device to defer the taxable gain on the sale of appreciated real property or the like.

. This is an introduction to the deferred sales trust and how it compares to the 1031 exchange. Cons of Deferred Sales Trust. And the Deferral Sales.

Typically when appreciated property is sold the gain is. In this video were going to take a look at the pros and cons of deferral sales trust. Complex to Set up.

Potential Disadvantages of Deferred Sales Trusts. Most of the clients also choose a lower. Let us conclude by discussing some of the pros and cons of deferred sales trusts.

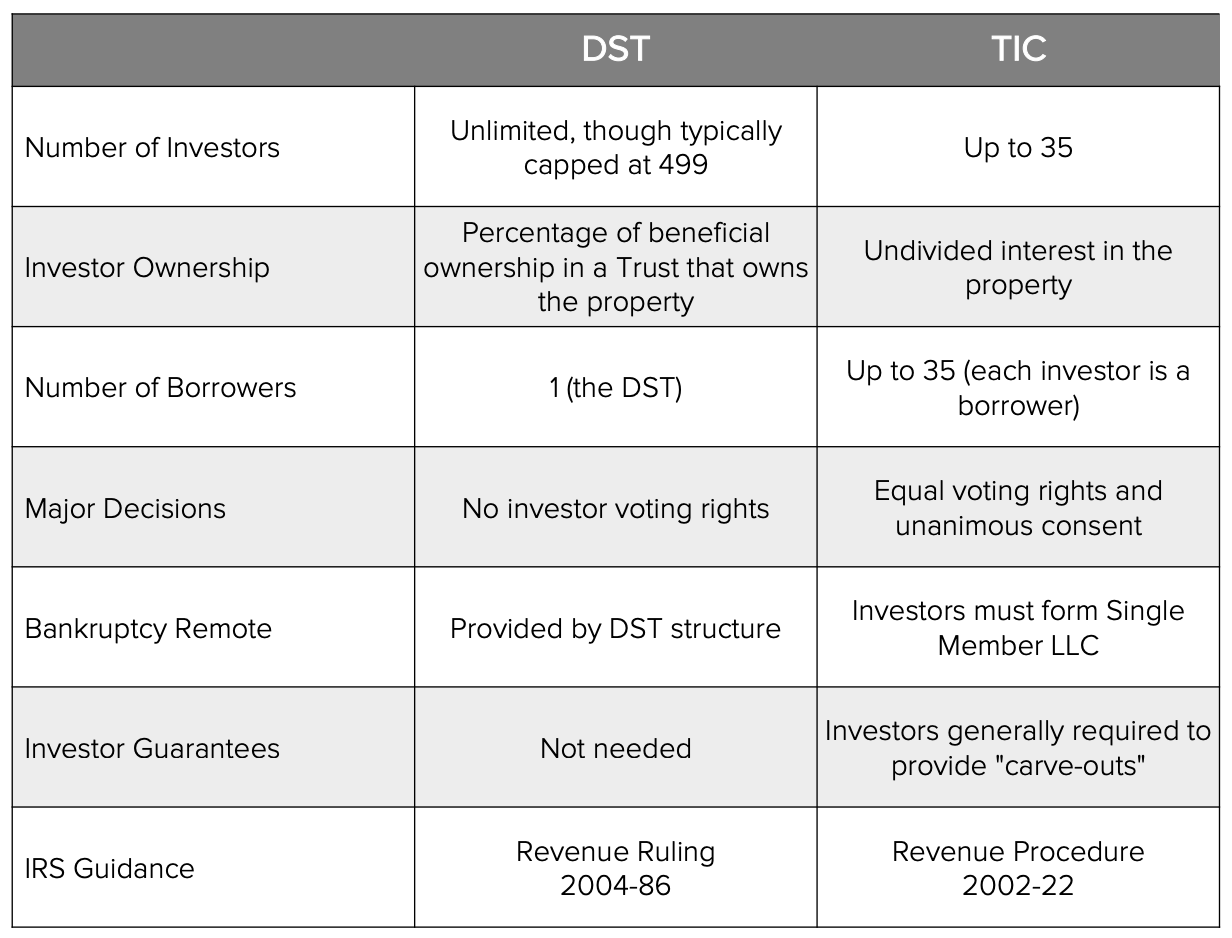

The Deferred Sales Trust or DST provides a unique exit strategy for. The strength of the deferred sales trust is its flexibility and relatives all pressure to purchase a property via a short time frame using a 1031 exchange. We will explore why so many high net worth individuals are leveraging.

Deferred sales trusts also come with a number of caveats that have the potential to increase investment risk. Ad Bank of America Private Bank Can Help Create Personalized Impact Investing Plans for You. Reviews from Brunswick Bank Trust employees about Brunswick Bank Trust culture salaries benefits work-life balance management job security and more.

Pros And Cons Of Deferred Sales Trust posted Jan 7 2019 1034 PM by David Leiker updated Jan 7 2019 1034 PM by David Leiker updated. Deferred Sales Trust Pros and Cons. Ad Bank of America Private Bank Can Help Create Personalized Impact Investing Plans for You.

DEFERRED COMPENSATION PLAN Notes to Financial Statements June 30 2017 and 2016 5 Continued 1 Description of the Plan a Organization The State of New Jersey Division of. The Deferred Sales Trust is a more complicated income tax structure than with other income tax planning strategies such as the 1031 exchange. The primary benefit of deferred sales trusts is.

Only few tax-deferral programs are easy to set up due to the complex guidelines associated with them. Financial position of the New Jersey State Employees Deferred Compensation Plan as of June 30 2010 and 2009 and the changes in its financial position for the years then ended in conformity. The Deferred Sales Trust or DST provides a unique exit strategy for an appreciated business or.

1031 Exchange Vs Deferred Sales Trust Video Series Youtube

The Tale Of Two Dst S Delaware Statutory Trust Vs Deferred Sales Trust Reef Point Llc

Deferred Sales Trust Capital Gains Deferral

The Pros And Cons Of Deferred Revenue Saas Metrics

How To Defer Capital Gains Taxes Without Time Limits Prei 375

The Pros And Cons Of Deferred Revenue Saas Metrics

Deferred Sales Trust Vs 1031 Exchange Youtube

Rental Property Exit Plan The Deferred Trust Sales

Deferred Sales Trust Problems Why Not A Dst When You Found A 1031 Property Youtube

The Pros And Cons Of Opportunity Zone Funds For The Passive Investor

Deferred Sales Trust Defer Capital Gains Tax

Deferred Sales Trusts Modern Wealth

1031 Exchange Vs Deferred Sales Trust Video Series Youtube

Delaware Statutory Trusts A Comprehensive Guide With Pros And Cons

Disadvantages To A Deferred Sales Trust Youtube

Pros And Cons Of The Deferred Sales Trust Reef Point Llc

68 Deferred Sales Trusts The Richer Geek

Sell Your Business With Maximum Gains Via Deferred Sales Trust With Brett Swarts Seiler Tucker